The Missing Middle: Why Indian MSMEs Fail to Scale Up

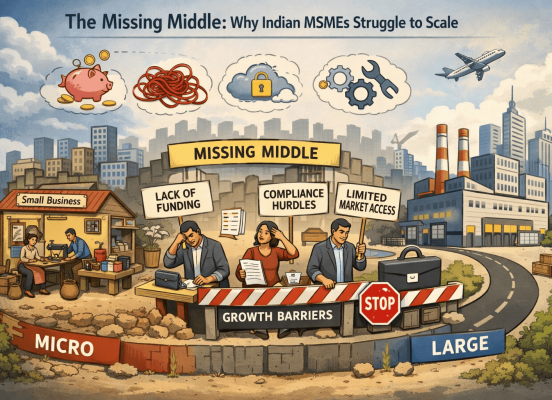

India’s MSME sector is often celebrated as the backbone of the economy that is innovative, resilient, and deeply entrepreneurial. Yet, beneath this success story lies a persistent structural problem: the “missing middle.” While India has millions of micro enterprises and a fair number of large corporations, too few firms successfully transition from small to medium and then to large scale. For entrepreneurs, this is not a failure of ambition, but of the ecosystem that surrounds them.

At the heart of the problem is access to growth capital. Micro enterprises may survive on informal credit, personal savings, or small loans, but scaling up demands patient capital, longer-tenure loans, equity, or quasi-equity. Many MSMEs find themselves stuck: too large for microfinance, yet too risky for traditional banks. Equity investors, meanwhile, often prefer tech startups or asset-light models, leaving manufacturing and traditional MSMEs underfunded.

Compliance and regulation form another major bottleneck. As firms grow, they cross multiple regulatory thresholds such as GST filings become more complex, labour laws multiply, quality certifications become mandatory, and inspections increase. Instead of being rewarded for growth, entrepreneurs often feel penalised by higher compliance costs and regulatory uncertainty. This creates a perverse incentive to remain small or fragment operations to avoid regulatory scrutiny.

Technology adoption is another missing link. While digital tools for accounting, marketing, logistics, and production are widely available, many MSMEs struggle to integrate them strategically. Scaling up requires not just adopting tools, but rethinking processes such as data-driven decision-making, supply chain integration, and productivity improvements. Without the right skills and advisory support, technology becomes an expense rather than a growth enabler.

Market access also constrains scale. Many MSMEs remain dependent on a few buyers, intermediaries, or local markets. This limits pricing power and growth potential. Entry into organised supply chains, government procurement, exports, or e-commerce platforms requires standardisation, branding, and consistency, areas where smaller firms often lack support. As a result, promising enterprises plateau despite strong demand.

Perhaps the most underestimated factor is managerial capacity. Indian entrepreneurs are often excellent operators, but scaling requires delegation, professional management, and long-term planning. Family-run structures, while stable at small scale, can struggle with governance, talent retention, and strategic decision-making as the business grows.

Solving the missing middle problem is critical for India’s economic future. It requires targeted policy support for scale-up finance, simplified and predictable compliance, technology handholding, and market linkages, not just startup incentives or survival schemes. For entrepreneurs, recognising that scale is a strategic transition, not just incremental growth, is equally important. Bridging the missing middle will unlock productivity, create quality jobs, and turn India’s vast base of small enterprises into globally competitive businesses.